Living or retiring in New Zealand?

Consolidate your UK pensions with a UK Pension Transfer New Zealand.

Whether you are migrating from the UK to New Zealand or a Kiwi Expat returning home, a New Zealand QROPS SIPP will help you achieve a superior income throughout retirement.

Basically, QROPS (Qualifying Recognised Overseas Pension Schemes) permit you to transfer and consolidate all UK pensions (inc frozen UK pensions) into a New Zealand personal pension(New Zealand QROPS SIPP).

Preferable tax treatment is a key advantage. The dreams of a more relaxed lifestyle could soon fade if you have to work around UK pension rules.

QROPS also offer huge amounts of flexibility in accessing your money through regular payments and lump sum withdrawals. Additionally, unlike the UK, should anything happen to you, your spouse and beneficiaries will receive 100% of the remaining assets as opposed to HMRC.

After your house, your pension is likely to be your second largest asset. So it is important to ask yourself if you really know what it is invested in? What its performance was last year? What charges are eroding your pot?

Consolidation also grants greater control of your retirement funds, increasing your buying power to seek the very best returns in the market. Plus, it goes without saying that numerous pension pots mean duplicate charges and excessive amounts of paperwork.

Finally, with a booming economy, retiree’s living in NZ on UK pension payments leave themselves at risk to exchange rate fluctuations that could see their retirement income plummet. With a UK/ New Zealand QROPS SIPP, you can lock-in a guaranteed retirement income.

Click here to learn more about Harrison Brook’s simple Pension Transfer New Zealand service.

Benefits of a Pension Transfer New Zealand

- No 55% tax charge for beneficiaries.

- Consolidation (performance, charges, admin).

- No annuity purchase necessary.

- QROPS can provide for your family, it is possible to use up to 100% of the fund to provide a spouses pension.

- 100% of pension pot left for beneficiaries (not possible in the UK).

- The broader range of investments to choose from.

- Tax-free lump sum.

- Receive pension income free from UK income tax (QROPS).

- Low cost charging structures.

What to consider before a UK Pension Transfer New Zealand?

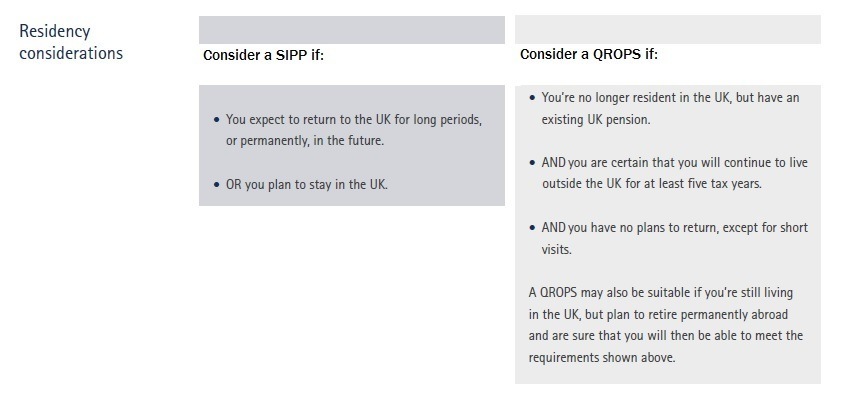

- Residency considerations: do you expect to return to the UK to retire or for long periods of time in the future?

Existing pension arrangements:

- Is your current pension plans worth less than £75,000?

- Are you current pensions defined benefit schemes?

- Do your existing schemes include benefits such as spouse’s pension, life cover and competitive charges?

Harrison Brook – Helping you make the best choice

Basically, UK pension transfers are a growing market and numerous QROPS providers are appearing regularly.

Talk to a Harrison Brook Financial Adviser to ensure that you choose the most appropriate provider for your British Pension Transfer New Zealand and that your QROPS investment portfolio is matched with your risk profile and growth expectations.

Why choose Harrison Brook for your UK Pension Transfer New Zealand?

- QROP structures available depending on your situation

- We offer discounted QROP fee structures through our online advice system – we pass the savings onto you

- If you prefer to meet an adviser on a face to face basis this can also be arranged

- UK qualified Adviser

- On-going advice and management – Quarterly investment reviews

- No restrictions on client location

- Access to institutional high rate deposit accounts and structured fixed return products

- Access to funds that have been handpicked by investment specialists in model portfolios which can be structured for capital growth, income generation or both

How do you take the first step?

To get your latest pension valuations and learn more about New Zealand QROPS SIPP with a UK Qualified Adviser (including benefits and if a QROP is the best solution for your pension planning) click here for a free, no obligation, personal financial analysis.

You can also request a free guide to UK Pension Transfers New Zealand by Contacting Us.