How can a QROPS assist in avoiding the Lifetime Allowance (LTA) charge?

Qualifying Recognised Overseas Pension Schemes (QROPS) can be an option for wealthy expats considering their options as the UK lifetime allowance cap on pensions was reduced to £1.25 million and is planning to continue to fall in years to come. The problem for wealthy retirement savers is anyone who has a pension fund that exceeds the cap faces the lifetime allowance excess tax charge of 25% on income and a 55% tax on lump sum’s. As the economy and rates of return on investments pick up, the risk for many retirement savers is their UK based SIPP or personal pension will soar through the threshold and leave them open to this tax charge.

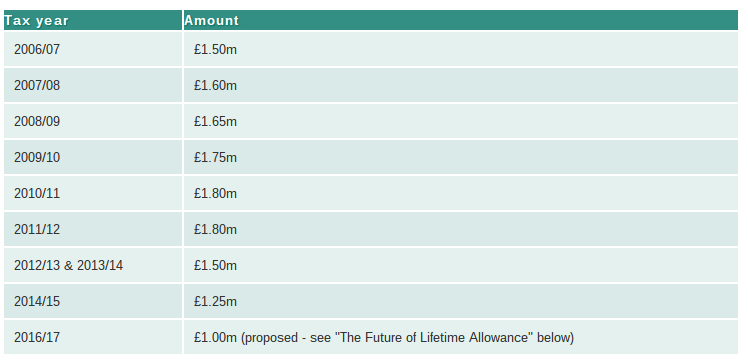

How has the Lifetime Allowance altered over the years?

How can QROPS legislation assist?

A transfer to a QROPS is a benefit crystallisation event (BCE 8), and the funds will be subject to a lifetime allowance test at that time, regardless of whether you as a member have reached pension age or intend to take an immediate income following the transfer. But the lifetime allowance only has significance in the UK (pre-transfer), and taking retirement benefits from former UK pension funds held in an overseas pension scheme will not trigger a BCE. This allows a client to use a QROPS to benefit from no maximum lifetime allowance.

Any growth in value of the QROPS above the value of the UK Lifetime Allowance (£1.25m 2014/2015) paid as a pension, will escape the 25% Lifetime Allowance excess tax charge. This charge would otherwise apply to any pension paid from a UK registered pension scheme to persons who are UK resident or non-resident for less than five years where the value of the pension exceeds the Lifetime Allowance (£1.25m 2014/2015).

What if the value of my pensions are over 1.25 million before transferring into a QROP?

When the transfer takes place, the HMRC will value your pension and compare it against your life time allowance (£1.25 million for 2014/2015). If the transfer value exceeds your unused allowance, you will be liable to a tax charge. But if you have registered your UK pension savings for primary protection, enhanced protection, fixed protection 2012, fixed protection 2014 or individual protection, you will be able to transfer the value of your UK pensions and protect the majority, if not all, of those savings from a tax charge if they exceed the standard lifetime allowance that applies at the time the transfer takes place.

What if you decide to retire back in the UK after transferring into a QROPS?

If your pension fund is close to or exceeds the lifetime allowance, it is possible to apply for an enhancement from HMRC. The enhancement factor will ensure that the investment growth attained in the QROPS and any amount previously tested against the lifetime allowance on transfer to the QROPS, will not be subject to a lifetime allowance tax charge in the future. Additionally, clients can benefit from the Harrison Brook Transfer Out / Switch Back Service.

Are you concerned by your pension Lifetime Allowance (LTA)? Interested in avoiding lifetime allowance charge?

Harrison Brook is your perfect cross border partner to understand what is best for your current situation. Simply ‘Get Started‘, speak to an adviser today for free, no obligation, financial analysis and information tailored for your situation.